“A catch-22 is a paradoxical situation from which an individual cannot escape because of contradictory rules or limitations. The term was coined by Joseph Heller in his 1961 novel Catch – 22” – Wikipedia

The Catch-22 is this: executives will not hire until they see sustainable sales growth and employees will not spend until they feel confident about their job future.

The issue today is sustainable employment. Executives and employees look to the other to take the first step to achieve sustainable employment. The recovery will not gain momentum until executives gain confidence in future sales. Employees will not buy as much as the executives prefer until the threat of layoffs abates and hiring resumes.

Executives need to see customers actively buying goods and services for at least a quarter or two to gain baseline confidence in sustainable sales. Then, management may begin hiring. If sales fall or become weak executives freeze hiring, end contractor work and permanently lay off employees.

As such, employees are worried about losing their jobs. A Gallup survey found more than 25% percent of all employees are concerned about future layoffs. If the present slow decline in economic activity accelerates it will cause executives to freeze hiring and consumers to further curtail spending. For more analysis of the executive – employee standoff and its economic implications please see our latest post at RIA:

Our Economy Is Dependent on Consumer – Workers

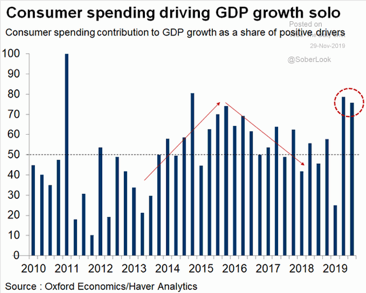

What is remarkable about this standoff is that it has actually been place a long time as the U.S. economy has grown more dependent on consumers for growth. On average consumer spending is about 70% of the drivers of GDP growth. Though, as the chart from Oxford Economics shows the contribution of consumer spending to positive drivers of GDP fluctuates by quarter. Recently, in the latest two quarters of 2019 consumer spending has surged to about 80%.

Sources: Oxford Economics, The Daily Shot – 10-2-2

Executives Increase Their Power In the Last 20 Years

As our economy shifted into a consumer based economy, management shifted production, manufacturing and non-core services like accounting overseas. At the same time the number of corporations competing in a number of industry sector has consolidated providing fewer job opportunities for workers. For example, in the entertainment industry in 1995 there were 93 different businesses in production, content distribution and talent development. Today, there are 6 mega companies that control 95% of entertainment content. There are 50% fewer public companies today than in 1992. Employees have seen their ability to find jobs at competing companies or related industries continue to fall. With fewer choices for employment management can drive the management – employee relationship in their favor. Union membership has declined from 27% in the 1970s to 13% by 2019.

CEO Pay Increases by 940%

Management has done a good job taking care of themselves by wasting approximately $1 trillion per year since 2008 on stock buy backs to goose the price of company stock. Thereby, increasing their income via executive stock compensation plans based on increasing share prices. Stock buyback funds went into taking stock off the market instead of raising employee wages, investing in productivity enhancements, new product development or employee training and development. The result of executive actions in most companies is the surge in the ration of average worker pay to CEO pay from 20 times in 1965 to 271 times in 2018, according to the Economic Policy Institute. CEO pay has increased 940% since 1978 and average worker pay has increased 12 %. Since 2009, CEO pay has increased by 59% and worker pay increased just 5.3%.

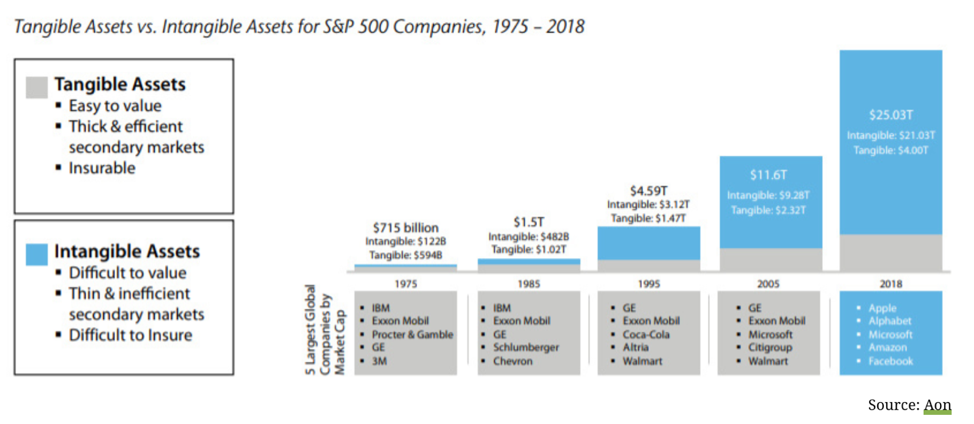

Labor Creating Knowledge is the New Asset

The services sector of our economy continues to grow faster than the goods producing sector. The new capital is actually knowledge. OCED reports that 40% of the U.S. workforce is in information services or 60M workers. As information technology drives business development across all sectors of our economy, intangible assets become more crucial to business success. In the following chart the growth of intangible assets has driven stock values to the point where 84% of asset valuation is in intangibles.

Sources: Aon, The Visual Capitalist – 2/11/2020

Note in 2020 that the leading companies in the S & P 500 index in capital valuation are information services companies like: Apple, Alphabet, Microsoft, Amazon and Facebook. Intangible assets are created by knowledge workers. Intangible assets include: brand, intellectual property, data and knowledge bases, royalty and property agreements, business and partner networks, goodwill, software licenses, non-compete agreements, and distribution channels. As the analysis calls out intangibles are hard to value while physical assets are much easier to value. The lack good valuation metrics for intangibles created by labor has limited the value of labor as seen by Wall Street investors, economists and policymakers.

Need A Labor – Capital Economy

Since Medici Bank accountants in the 15th century developed credit and debit accounting standards for expenses and income labor has been labeled as a cost. Cost on a social value basis was viewed as less valuable than money. Capitalists purchased labor and provided them work. Labor was a means of gaining wealth not sharing wealth. Labor throughout time has had to fight for it is rightful place in any economy Even just the name of our economy shows what’s valued “Capitalist Economy”. Where is labor in this equation of capital to labor? Labor is not even in the name of the economy. We think to build a stronger economy that works for all needs a new name: Labor – Capital Economy. Labor goes first in the name because people create wealth and value not money. When did you ever see a dollar create an iPhone? Where the interests of labor and capital are sustained with equal power in the architecture of the economy by government, Wall Street, and corporations. Our institution set the power relationships between labor and capital by setting the rules of the economic game.

How To Begin To Make The Change

First, we need to reframe our thinking and start focusing on calling for a future economy based on labor – capital partnership. Let’s call the future economy the Labor – Capital Economy. The necessary changes in laws need to be accomplished for labor and corporate reform by governments. Corporate management will need to see that it actually is in their interests to balance the needs of capital creation and labor benefits. Wall Street investors will start to look for investments in companies that are both profitable but also impacting society in a positive direction supporting greater distribution of wealth across all worker groups.

We will dive into more depth on key reforms, innovations and initiatives to create a future economy that works for all in a series of future posts.