Since the pandemic emergency was declared in mid-March 2020, renters and low-income homeowners have accumulated almost $100B in rent and mortgage debt (please see our post on the Housing Debt Bubble for more details). Today, to avoid a surge in delinquencies, renters and homeowners have worked with mortgage holders to setup forbearance programs to repay loans over time. The federally mandated rent and housing mortgage moratorium on evictions are due to expire on January 31st. Only $25M of the $900B COVID relief bill signed on December 30th goes to rent relief. The Housing Debt Bubble is growing by $9 – 10B per month. The crisis continues to fester.

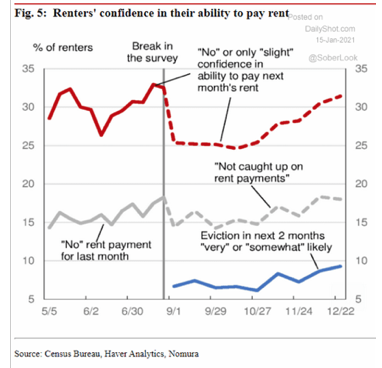

Over 30% of renters report that they have ‘no’ or ‘slight’ confidence that they will be able to make the next month’s rent payment.

Sources: Census Bureau, Haver Analytics, Nomura, The Daily Shot – 1/15/21

Over 12M households face eviction after January 31st. Relief checks help but are not a long term solution to the problem. It is not just renters that are struggling. Small business owners of multi-unit apartment buildings have difficulty making mortgage payments when they do not receive rental income. Small businesses own 50% of all multi-unit apartment buildings or 22M units. One-third of these businesses are building debt obligations. Plus, these landlords create more debt by using temporary forbearance plans to gain time, hoping that renters will begin to pay monthly rent.

COVID Bonds – A Way to Workout Housing Debt

Can we create a workout program for both renters and small business owners of multi-unit buildings? The Federal Reserve has programs buying junk bonds of businesses with negative earnings and speculative hedge funds that have lost millions of dollars in high-risk investments.

So, why not have the Fed support a program of ‘COVID Bonds’? COVID Bonds would be backed by the government with low-cost Fed Funds rate of .25%. The bond money would be available to renters and small businesses alike. Renters could apply to a designated city or state agency offered to pay off the debt and pay back the principal over 5 – 10 years. Homeowners could apply for loans to Freddie Mac or Ginnie Mae if they have a federally backed home loan or a local community bank. Community banks could work with small businesses providing .25% loans when renters have become delinquent and evicted, while the apartment owner holds a growing level of unpaid mortgage debt.

Small Businesses Can Pay Off Higher Interest Debt

Small businesses could pay off the old debt higher interest debt with a new low interest COVID loan. The COVID loan would offer a 5 – 10 year payback period with a low cost .25% interest rate. There is $3T in savings by companies and individuals deposited in money market funds or banks. Why not run a ‘Buy COVID Bonds’ program putting this $3T in savings to pay down federal debt? Bringing people together to buy COVID bonds to help those hurt badly by the pandemic would help unify the country.

The program would work down some renter, low-income homeowner, and small business debt using taxpayer-supported government financing of COVID Bonds. We can support the people hurt the worst by the pandemic by offering a lifeline while reducing pandemic debt.